A Comprehensive Guide to HDFCs and Affordable Homeownership Programs

New York City’s affordable housing landscape includes several distinct programs designed to create and preserve homeownership opportunities for low- to moderate-income residents. Among these programs, Housing Development Fund Corporation cooperatives, commonly referred to as HDFCs, represent one of the City’s most important and technically complex affordable homeownership models.

With more than 1,100 HDFC buildings across the five boroughs, these cooperatives make up a meaningful portion of New York City’s cooperative housing stock. Understanding how HDFCs function, how they differ from other income-restricted housing programs, and how they are valued is essential for buyers, owners, lenders, estate fiduciaries, and legal professionals.

Property owners and professionals frequently rely on experienced Manhattan real estate appraisal services when dealing with HDFC transactions involving refinancing, estate planning, litigation support, or purchase decisions.

The Landscape of Income-Restricted Housing in New York City

Before examining HDFC cooperatives in detail, it is important to understand the broader framework of income-restricted housing in New York City. The City contains several distinct affordable housing programs, each operating under different statutes and regulatory structures.

The most prominent income-restricted housing programs include Mitchell-Lama housing, Low-Income Housing Tax Credit (LIHTC) developments, and Housing Development Fund Corporation cooperatives. While these programs share the goal of promoting housing affordability, they differ substantially in ownership structure, regulatory oversight, financing options, resale limitations, and valuation implications.

Mitchell-Lama Housing

The Mitchell-Lama Housing Program was created in 1955 under the Limited Profit Housing Act to encourage private developers to construct affordable housing for middle-income households. In exchange for tax abatements and low-interest financing, developers agreed to long-term affordability restrictions and regulatory oversight.

Between 1955 and the late 1970s, the program produced more than 135,000 housing units statewide, with tens of thousands of apartments still remaining in the program today. Mitchell-Lama developments include both rental apartments and limited-equity cooperatives and are privately owned and managed.

Unlike HDFC cooperatives, Mitchell-Lama buildings may exit the program after prepaying their underlying mortgages, subject to regulatory approvals and tenant protections. Eligibility requirements, waiting lists, regulatory oversight, and program rules are administered by NYC Housing Preservation and Development’s Mitchell-Lama Housing Program.

Low-Income Housing Tax Credit (LIHTC) Properties

The Low-Income Housing Tax Credit program was established by the Tax Reform Act of 1986 and is the primary federal mechanism for financing affordable rental housing in the United States. In New York City, tax credits are allocated and administered through NYC Housing Preservation and Development.

LIHTC developments are predominantly rental properties serving low- and very-low-income households and are subject to extended compliance periods, often lasting 30 years or more. Because LIHTC properties do not involve owner-occupied cooperative ownership, they are generally not comparable to HDFC cooperatives for valuation or ownership analysis.

Housing Development Fund Corporation Cooperatives: Origins and History

HDFC cooperatives emerged during New York City’s fiscal crisis of the 1970s, when widespread landlord abandonment left thousands of residential buildings vacant or severely deteriorated. In response, the City implemented programs to transfer ownership of distressed properties to tenants or nonprofit entities for nominal consideration.

Through initiatives administered by NYC Housing Preservation and Development, buildings were often conveyed for minimal cost. The residents who assumed ownership, frequently referred to as urban homesteaders, invested significant sweat equity to rehabilitate their buildings and establish cooperative ownership structures.

Many of these formerly distressed properties now operate as stable, resident-controlled cooperatives throughout Manhattan, Brooklyn, the Bronx, and parts of Queens.

Legal Framework: Article XI of the Private Housing Finance Law

All HDFC cooperatives are incorporated under Article XI of the New York State Private Housing Finance Law. Article XI establishes HDFCs as special-purpose corporations organized exclusively to provide housing for persons and families of low income.

Under this framework, HDFCs are required to operate primarily for the benefit of resident shareholders, maintain owner-occupancy, and preserve affordability on a long-term basis. Unlike other affordable housing programs, Article XI does not include a statutory exit mechanism allowing conversion to unrestricted market-rate housing.

However, Article XI does not prescribe specific income limits or resale formulas. These details are governed by regulatory agreements, certificates of incorporation, bylaws, proprietary leases, and internal policies, resulting in substantial variation among HDFC cooperatives.

Income Eligibility and Area Median Income (AMI)

Income eligibility is a defining feature of HDFC cooperatives. Most HDFCs restrict ownership to households earning no more than a specified percentage of Area Median Income (AMI).

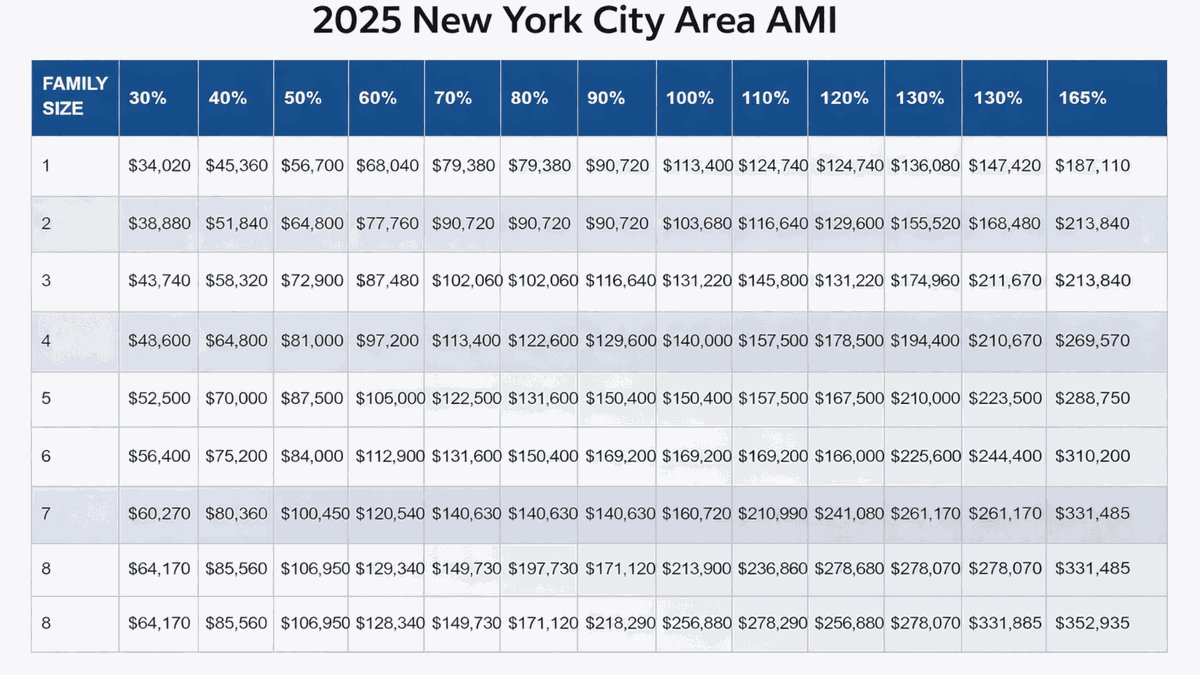

Depending on the cooperative, income limits may range from 80 percent to 165 percent of Area Median Income. These thresholds are typically established in the cooperative’s governing documents or regulatory agreements.

AMI figures are published annually by the U.S. Department of Housing and Urban Development and adopted locally by NYC HPD. Because AMI varies by household size and year, eligibility standards may change over time even if the percentage cap remains unchanged.

Income Calculation Methods

HDFC cooperatives generally rely on one of two income calculation methodologies. Some cooperatives apply income limits directly as a percentage of AMI using HUD-published figures. Others rely on a statutory formula tied to housing costs, including monthly maintenance charges and utilities.

The income calculation methodology used by a particular cooperative can materially affect buyer eligibility and should be reviewed carefully in any HDFC transaction.

Regulatory Agreements and Ongoing Restrictions

Some HDFC cooperatives operate under formal regulatory agreements with NYC HPD that explicitly govern resale prices, income limits, approval procedures, and ongoing compliance obligations. Other cooperatives rely primarily on their corporate purpose under Article XI and their internal governing documents.

Even where formal agreements have expired, many cooperatives continue to impose income restrictions based on historic practice or lender requirements. This regulatory gray area can introduce uncertainty for buyers, lenders, and valuation professionals.

Appraisal Considerations for HDFC Cooperatives

From a valuation perspective, HDFC cooperatives present challenges not typically encountered in market-rate housing. Income restrictions limit the pool of eligible buyers, resale restrictions cap appreciation potential, and regulatory uncertainty can affect exposure time and perceived risk.

Comparable sales are often drawn from other income-restricted cooperatives rather than unrestricted market transactions. Property owners throughout the City frequently rely on Manhattan appraisal services, Brooklyn appraisal services, Queens appraisal services, Bronx appraisal services, and Staten Island appraisal services when dealing with these specialized valuation assignments.

Because of the legal and regulatory complexity associated with HDFC cooperatives, valuation assignments often require additional analysis beyond that of a typical market-rate apartment. Property owners, attorneys, and fiduciaries seeking guidance are encouraged to contact Block Appraisals to discuss the scope and requirements of a specific assignment.

Conclusion

HDFC cooperatives remain an essential component of New York City’s affordable homeownership landscape. Their legal structure, income eligibility requirements, and resale limitations distinguish them from conventional housing and require specialized analysis.

For buyers, owners, estate fiduciaries, and professionals involved in HDFC transactions, a clear understanding of AMI limits, regulatory oversight, and market behavior is essential.