So, you’re ready to start the application process for your next mortgage. *Now, what?* For the vast majority of lenders, a property appraisal will be required to determine the value of the prospective property, and working with an expert appraiser in NYC can help guarantee you get the most accurate information possible for your mortgage.

In fact, a reliable mortgage appraisal can help reduce the overall costs of the real estate transaction for buyers *and sellers* alike. The appraisal protects everyone involved—ensuring lenders don’t over-extend credit, buyers don’t overpay, and sellers receive fair market value. It’s the financial foundation of your real estate transaction.

A mortgage appraisal is an unbiased professional opinion of a property’s market value, conducted by a licensed appraiser. Unlike automated valuation models or real estate agent opinions, a mortgage appraisal involves physical inspection, detailed market analysis, and adherence to strict professional standards.

Lenders require appraisals to verify that the property provides adequate collateral for the loan amount. For example, if you’re seeking an $800,000 mortgage, the lender typically requires the property to appraise for significantly more—usually at least $1,000,000 assuming a conventional loan with 20% down. Lenders don’t allow you to borrow 100% of the appraised value; instead, they limit loans based on loan-to-value (LTV) ratios, commonly 80% for conventional loans, 96.5% for FHA, or up to 100% for VA loans. This protects both the lender’s investment and your financial interests as a borrower.

Purchase Mortgages: Nearly all purchase transactions involving financing require an appraisal. The lender needs to verify the purchase price aligns with market value before approving the loan.

Refinance Appraisals: When refinancing, lenders reassess your property’s current value to determine loan-to-value ratios and qualification. A strong appraisal can help you eliminate PMI or access better rates.

Cash-Out Refinancing: Extracting equity requires an appraisal to determine how much equity is available. The appraisal establishes the current value minus your existing mortgage balance.

Home Equity Lines of Credit (HELOC): Lenders require appraisals to determine available equity and establish credit limits for home equity financing.

Reverse Mortgages: Seniors seeking reverse mortgages need appraisals to determine the maximum loan amount based on property value and age factors.

SBA Loans: Small Business Administration loans for commercial or mixed-use properties require appraisals meeting specific SBA guidelines and lending requirements.

Hard Money Loans: Private or hard money lenders typically require appraisals to establish loan-to-value ratios for short-term or alternative financing situations.

Construction Loans: Permanent financing or construction-to-permanent loans require appraisals based on the completed value of the project, including planned improvements.

Appraisals are typically requested by the lender during the mortgage application process and are a key component of the underwriting process as well. This evaluation determines how much money a lender is willing to loan you for your home. A thorough, accurate appraisal protects you from overpaying for a property and ensures your financing terms are sound.

Without a proper appraisal, you could face several financial consequences:

Although most property appraisals are geared towards potential buyers, it can also benefit sellers to understand the true market value of their home. A pre-listing appraisal ensures you price your property competitively without leaving money on the table.

Sellers benefit from appraisals in several ways: accurate pricing prevents extended market time from overpricing, understanding appraisal methodology helps you prepare the property for the buyer's appraiser, and having a recent appraisal strengthens your negotiating position if the buyer's appraisal comes in low. Knowledge of your property's true value protects you throughout the transaction.

Understanding the factors appraisers consider helps you prepare for the appraisal and potentially maximize your property’s assessed value:

Comparable Sales: Recent sales of similar properties in your neighborhood provide the foundation for most appraisals. Appraisers analyze sold properties with similar size, age, condition, and location.

Property Condition: Overall maintenance, updates, and improvements directly impact value. Deferred maintenance, visible damage, or outdated systems can reduce the appraisal value.

Location Factors: Neighborhood desirability, school districts, proximity to transportation, local amenities, and recent area development all influence value significantly in NYC’s micro-markets.

Square Footage & Layout: Usable living space, bedroom/bathroom count, and functional layouts affect value. Appraisers measure and verify all habitable areas.

Building Amenities: In condos and co-ops, amenities like doorman service, fitness centers, parking, outdoor space, and building condition impact individual unit values.

Recent Improvements: Kitchen and bathroom renovations, mechanical system upgrades, and other capital improvements add value when properly documented and appropriate for the neighborhood.

Market Conditions: Current supply and demand dynamics, interest rate environment, and overall market trends affect values. NYC’s market can vary significantly by borough and neighborhood.

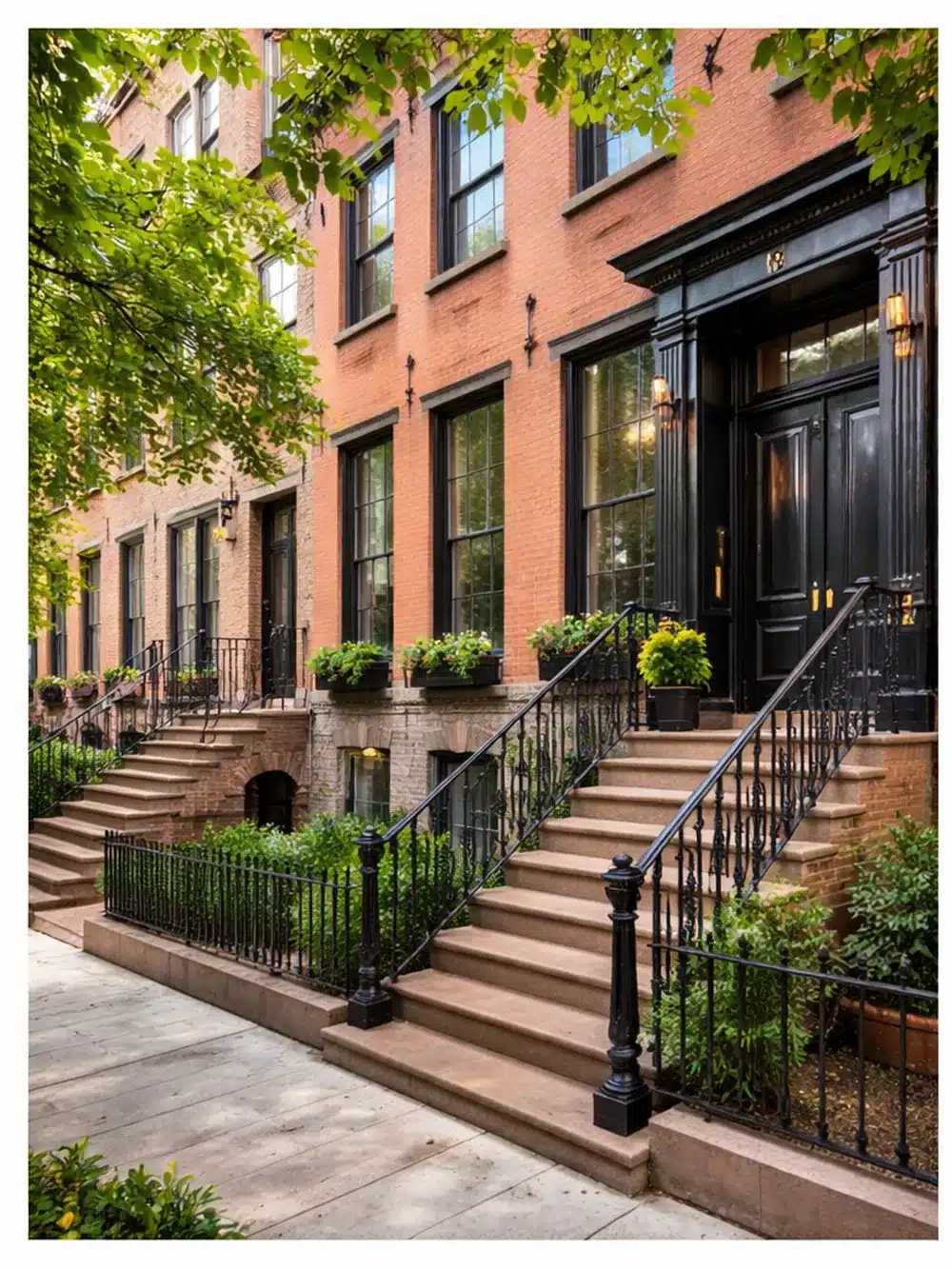

New York City’s unique real estate market presents specific challenges that require specialized appraisal expertise:

Co-op vs. Condo Distinctions: Co-ops require different valuation approaches than condos. Board approval processes, flip taxes, subletting restrictions, and financial requirements affect marketability and value.

Building Financial Health: In co-ops and condos, building finances, reserve funds, outstanding litigation, and upcoming assessments can significantly impact individual unit values and lending approval.

Neighborhood Micro-Markets: Values can vary dramatically between blocks in NYC. Understanding hyper-local market dynamics, development trends, and neighborhood shifts is essential to accurate valuation.

Historical Sales Data: NYC’s transparent sales data through ACRIS and the DOF provides robust comparable sales information, but requires expertise to interpret correctly given the complexity of deed types and transaction structures.

Unique Property Types: Brownstones, townhouses, lofts, and converted units require specialized knowledge of how these property types are valued differently than standard apartments.

If the appraisal is below the purchase price, you have several options: negotiate a lower price with the seller, increase your down payment to cover the difference, challenge the appraisal with supporting data if you believe it’s inaccurate, or walk away from the transaction if your contract includes an appraisal contingency.

Yes, and it’s often beneficial. You can point out recent improvements, provide documentation of renovations, and answer questions about the property. However, avoid attempting to influence the appraiser’s professional judgment.

Most lenders accept appraisals for 90-120 days. After this period, they may require an appraisal update or a new appraisal, especially in rapidly changing markets.

Not necessarily. Improvements must be appropriate for the neighborhood and property type. Over-improving beyond neighborhood standards may not yield proportional value increases.

Maximize your appraisal value with proper preparation:

Complete minor repairs, ensure all systems are operational, clean and declutter thoroughly, ensure good lighting throughout, and provide clear access to all areas including basements, attics, and mechanical rooms.

Gather recent comparable sales information, renovation receipts and permits, HOA or co-op financial statements, property tax bills, and surveys or floor plans if available.

Recent kitchen or bathroom updates, new appliances, mechanical system replacements (HVAC, water heater, boiler), roof repairs or replacement, and any structural improvements or additions.

Be flexible with scheduling to avoid delays, ensure all areas are accessible, inform the appraiser of any access codes or special entry requirements, and arrange for someone to be present if you cannot attend.

Understanding the lender-appraiser relationship helps set proper expectations:

Appraiser Independence: Federal regulations require appraiser independence. Lenders cannot influence appraisal outcomes, and you cannot choose your own appraiser for a lender-required appraisal.

Communication Protocols: Communication typically flows through the lender or appraisal management company. Direct contact with the appraiser is limited to scheduling and property access.

Reconsideration Process: If you believe the appraisal contains factual errors or used inappropriate comparables, you can request reconsideration through your lender with supporting documentation.

Private Appraisals: While you can order a private appraisal for your own information, it’s important to understand that lenders typically will not accept an appraisal that was not ordered by them. If you’re considering getting your own appraisal, check with your lender first about their policies. However, a private appraisal can still provide valuable information for negotiations or support a reconsideration request if the lender’s appraisal comes in low.

Refinance appraisals differ from purchase appraisals in important ways:

Equity Determination: The primary goal is establishing current equity to determine loan-to-value ratio. This affects your interest rate, PMI requirements, and qualification for cash-out financing.

No Purchase Price Anchor: Without a recent purchase price, the appraiser relies entirely on comparable sales and current market conditions. Recent market appreciation can work in your favor.

PMI Elimination: If your original loan included PMI and your LTV has dropped below 80% through appreciation or principal paydown, a strong appraisal can help eliminate this monthly expense.

Rate & Term Considerations: Better appraisals can unlock lower interest rates and more favorable loan terms. Even small value increases can move you into better pricing tiers.

Strategic Timing: Consider market conditions and recent comparable sales when timing your refinance. A strong market with recent high-value sales supports better appraisals.

Mortgage Appraisal Report

Detailed documentation of size, layout, condition, features, amenities, and property characteristics.

Assessment of location, neighborhood trends, nearby amenities, transportation access, and market conditions.

Detailed review of comparable properties recently sold, with as many comparables as needed for a well-supported value determination, including adjustments for differences in size, condition, location, and features.

Explanation of approaches used (Sales Comparison, Cost, Income when applicable) and reconciliation of value indicators.

Visual documentation of property condition, improvements, and characteristics. Interior photographs included where applicable based on assignment type.

Floor plan diagram with measurements used to calculate gross living area.

Overview of local market trends, days on market, absorption rates, and pricing trends in your submarket.

Professional conclusion of market value as of the inspection date, based on final reconciliation of supporting analysis and data.

Different loan types have varying appraisal requirements:

More stringent property condition standards, specific safety and habitability requirements, peeling paint issues in older homes, and mandatory repairs before closing. FHA appraisals remain with the property for 120 days.

Strict property condition requirements, mandatory well and septic inspections when applicable, focus on safety and sanitation, and notice of value (NOV) stays with property for six months, potentially limiting refinance timing.

Most flexible property condition standards, focus primarily on market value with less emphasis on minor condition issues, and faster processing timelines in most cases.

Connect with our team today and we will make sure to help you out with your needs. Call us now or send us a message.